It’s a tricky time to be an investor. On the just one hand, the 2020 industry rally seems relentless, so each day you might be on the sidelines is a working day you are missing out on potential gains. On the other hand, the S&P 500‘s 70% rebound from March’s low feels overdone, location the stage for profit-taking at any time.

Granted, that 70% run-up took shape following a sizable COVID-19-inspired setback. The S&P 500’s year-to-day get of 16% is a fairly typical total-yr consequence that simply balances out the steep sell-off with the recovery. Even so, uncertainties about a lot more gains being created in the fast long run are understandable.

If which is what your gut is telling you, have confidence in it. Just do not confuse what your intestine is telling you about the shorter phrase with a extensive-phrase outlook. Earnings are nevertheless increasing, as is the international economic climate. This in the end indicates any big dip is a shopping for chance to capitalize on.

Graphic supply: Getty Images.

Strained valuations

There is certainly no denying the toll that COVID-19 has taken on the around the world financial system, and by extension, company income. The first quarter’s for each-share earnings for the S&P 500 — the time at which the pandemic’s impression was the best — were being about half of the collective bottom line produced in the first quarter of 2019. Profits have considering that started to get well as firms figured out how to cope with stymied desire and logistics hurdles. Earnings are however subpar although, and they are projected to continue being lackluster via the very first quarter of 2021.

A amusing thing is envisioned to materialize all around the middle of the coming yr, on the other hand. Revenue are expected to attain their pre-pandemic amounts, en route to exceeding them by the latter half of 2021. The graphic under puts the new past and the around upcoming in standpoint.

Info resource: Standard & Poor’s. Chart by writer.

As lengthy as earnings proceed to make improvements to, the inventory current market really should discover a tailwind.

That is a greater-photo perspective however, measured in months. A lot can come about in the days and months in the meantime to make life relatively depressing for buyers. Blame the incredible operate-up since March’s base.

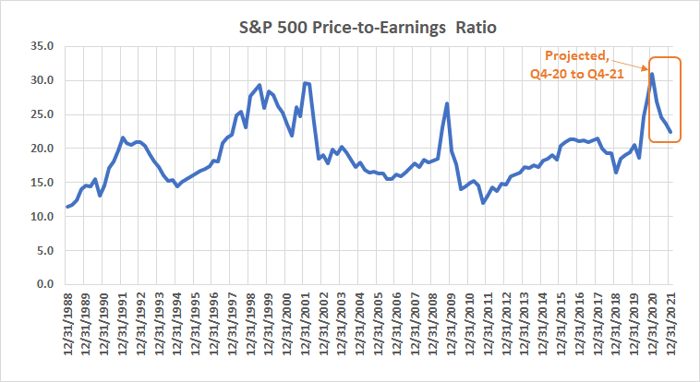

Whilst the optimism that took form pursuing February and March’s dread-driven plunge was nicely-intended, it was also overdone. Seem pondering was upended by the dread of missing out someday close to the middle of 2020 when valuations — previous and projected — moved to uncomfortably substantial concentrations. That did not halt the rally, of course. The S&P 500 is now trading at 30.3 occasions its trailing-12-month earnings and 22.4 periods its ahead-wanting for every-share earnings. That is the optimum trailing value-to-earnings ratio considering the fact that 2001 (when the dot-com bubble lastly burst). The index’s ahead-hunting cost-to-earnings ratio hasn’t been at 22 given that the same time.

Information source: Regular & Poor’s. Chart by creator.

Simply place, stocks are costly even if firms are capable to achieve their lofty earnings targets in 2021.

Get ready to pivot

Frothy valuations may possibly established the phase for a marketplace-large chill, but they do not essentially trigger one. Stocks have been overbought and overvalued for some time now, and it can be not stopped the bulls still.

From an odds-generating standpoint even though, the most modern leg of the rally from March’s reduced has carried shares to price ranges that will be complicated to maintain, even with a ongoing earnings restoration. Investors may well be basing their daring bets on the tempo of the rebound witnessed for the duration of the latter fifty percent of this yr, forgetting that the bar was set reduced by a horrific initially-quarter meltdown. The coming year’s speed of development will not be approximately as outstanding as the previous few months have been, which could easily deflate the optimism that’s buoyed stocks of late.

As for timing, the market’s December rally tends to linger into January, and there is certainly minimal purpose to consider this time all around will be any distinctive. The moment buyers have a possibility to study the landscape and acknowledge the earnings progress outlooks by now aspect in an close to the pandemic, on the other hand, the broad bullish undertow could weaken. That realization need to materialize sooner than later, suggesting some turbulence followed by a modest headwind is on the horizon.

None of this is necessarily a phone to get out of the sector, of system. As was by now noted, any respectable dip is a getting opportunity. The modifying backdrop is just a rationale to update your tactic. The volatility that rewarded short-phrase speculation in 2020 would not be in area in 2021. Sitting on responsible, quality names like Verizon Communications or Alphabet for more time holding periods will finally yield better benefits in the natural environment ahead.

10 shares we like improved than S&P 500 Price tag Return

When investing geniuses David and Tom Gardner have a stock idea, it can shell out to hear. Just after all, the publication they have operate for above a ten years, Motley Idiot Inventory Advisor, has tripled the current market.*

David and Tom just disclosed what they imagine are the ten most effective shares for investors to invest in right now… and S&P 500 Price Return was not one of them! Which is ideal — they believe these 10 stocks are even much better buys.

*Stock Advisor returns as of November 20, 2020

Suzanne Frey, an government at Alphabet, is a member of The Motley Fool’s board of directors. James Brumley owns shares of Alphabet (A shares). The Motley Idiot owns shares of and endorses Alphabet (A shares) and Alphabet (C shares). The Motley Fool recommends Verizon Communications. The Motley Fool has a disclosure coverage.

The sights and opinions expressed herein are the sights and opinions of the writer and do not essentially mirror all those of Nasdaq, Inc.

More Stories

Astral Travel -The Seven Planes of the Astral Qorld

Travel Essentials For Men

Travel Brochures