Giselleflissak/E+ via Getty Images

Investment thesis

For the next year and a half, at least till the end of 2023, we will witness a growth in travel that will take many of the major players ahead of their 2019 results. I believe Booking Holdings Inc. (NASDAQ:BKNG) and Airbnb, Inc. (NASDAQ:ABNB) are going to benefit the most from this surge because they run a business that is not so much hit by higher fuel costs and building maintenance.

What Costco and Target revealed

While I was writing about what we should have considered ahead of Costco’s (COST) earnings, I read Costco’s and Target’s (TGT) earnings reports and I was struck by a recurring theme.

Target’s Chief Growth Officer Christina Hennington pointed out that the retailer’s:

guests are focused on getting back to many of the habits and behaviors they suspended during the heart of the pandemic, including travel, out-of-home activities, and social gatherings. Luggage grew more than 50% as the world continues to reopen, and we reunite with the places and people we have missed visiting.

Please notice that already in the Q1 2021 earnings call, Hennington had pointed out the explosive demand for luggage. Now we are seeing another 50% increase from the point we were at last year.

Costco’s earnings showed in a curious way that people are traveling. First of all, Richard Galanti, Costco’s CFO, could not participate at the earnings call because he was in Italy on a rescheduled vacation that he had to cancel at the beginning of the pandemic.

Costco did report, too, that the best performers came in from gasoline, travel, food courts and that travel was taking off with great strength.

Even though many were expecting this travel rebound, the two retailers provided us indirectly with some data that hint towards a faster-than-expected acceleration of this industry, that will probably end up this year above the 2019 benchmark.

How is Booking doing?

In the last earnings call for Q1 2022, Booking reported that unique customers at booking.com were within 95% of 2019 levels. In addition, the company reported $27 billion of gross bookings in Q1 that sets a new record compared to $25 billion in Q1 2019. Thus, there is still a 5% recovery to make, but gross bookings increased already by 8%. Just to feel the pulse of this strong acceleration, Booking also said that March 2022 was the first month during which gross bookings exceeded $10 billion in a single month. Compared to March 2019, Booking is up 17%.

Clearly, everyone is interested in gross bookings for summer in the northern hemisphere, when travel is traditionally the strongest. Booking announced that, so far, its gross bookings for summer were more than 15% higher than they were at this time in 2019. This is a trend that still has room to grow and that is setting up as if this summer may really be a record travel season.

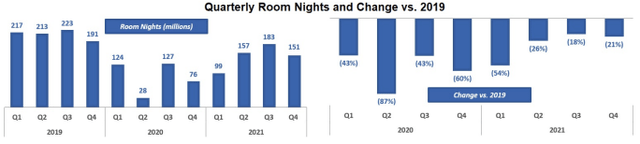

If we look at the chart below, taken from Booking’s 2021 annual report, we see the quarterly room nights from 2019 to 2021. It appears clearly that at the end of last year Booking was still in recovery mode.

Booking’s 2021 Annual Report

In Q1 2022 Booking reported that room nights booked increased 100% from the prior-year quarter. That means that they barely reached 200, still a bit below Q1 2019. But, based on what Bookings reported about the developing trend and knowing what consumers are choosing to buy at retailers, we can really expect that from Q2 2022 we will see the company beat its 2019 results even in terms of quarterly room nights.

Airbnb is growing and becoming profitable

Airbnb is actually doing even better than Booking, since it has already recovered from the pandemic. Airbnb Q1 2022 results showed that the company surpassed pre-pandemic levels of nights and experiences booked, breaking for the first time the 100 million barrier. With 102.1 million bookings, the company was up 57% YoY and 26% from the 2019 levels. Gross booking value grew as well reaching $17.2 billion, a 67% increase YoY and a 73% increase from 2019. Airbnb’s revenue was $1.5 billion, 80% more than the 2019 revenue.

Airbnb still ran at a loss of $19 million, but this is an enormous improvement from the $1.2 billion net loss of Q1 2021 and the net loss of $292 million in Q1 2019. From an adjusted EBITDA point of view, Airbnb was already profitable with $229 million and a margin of 15%. This was due to renewed discipline in managing the cost structure that was helped by the reduction of 25% of the workforce in 2020. Airbnb has now 16% fewer people at the end of Q1 2022 than at the end of Q1 2020, and yet it is reaching better results.

Last, just to understand how strong the company is growing, Airbnb reached in Q1 $1 billion in free cash flow, a sum that is only meant to increase. I expect this to be the last Q1 with a net loss for the company, that, in any case, has already reached profitability in all the other quarters. This is why I have almost no doubt in believing 2022 to be Airbnb’s first full year with a positive net income, turning the company profitable.

There are some trends the company highlighted that are driving this growth: guests are booking more, guests are returning to cities and crossing borders, guests stay longer and rent houses for long-term stays enhanced by smart-working policies that many companies are adopting. In addition, the number of hosts increased by 15%, helping Airbnb meet the need of increasing supply.

One interesting strength of Airbnb is its brand value, that enables the company to control marketing expenses. In fact, the company keeps on reporting that word-of-mouth has been one of its greatest drivers in growing as guests talk to other people and explain how easy it is to book a stay and as guests, having experienced the stay, start thinking about turning into hosts and about listing their home too on the app.

Airbnb estimates that its serviceable addressable market (“SAM”) is worth today about $1.5 trillion, including $1.2 trillion for short-term stays and $239 billion for experiences. The number is even greater if we consider the total addressable market (“TAM”), which is worth something around $3.4 trillion. With a 2021 revenue of $6 billion, there is plenty of space to gain market share. I expect the company to reach $8 billion this year and $10 billion by 2023.

But what if a recession happens? During the last earnings call, Mr. Chesky was asked about this possible issue. This is his interesting answer:

We launched on August 11, 2008. So you’ll remember what the world was like in August 2008. And we really got going January, February, March of 2009, in the depths of the Great Recession. And the reason that Airbnb initially grew was that people were having trouble paying their rent, having trouble keeping their homes, and people turn to Airbnb to list their homes. And what we generally see is in recessions, people change their behavior. And they change their behavior based on kind of price considerations. And so what we’ll generally expect in a recession, if that were to happen, is that probably more people would turn to hosting. That would be number one. So that we would expect, and number two, travelers would probably become more budget conscious. And that would probably have a benefit to Airbnb as well.

Comparison and valuation

Booking and Airbnb are not complete competitors, since Booking offers not only apartments but also hotel rooms, car rentals and now even flights. It is also a more mature company as its PE of 22 shows. Booking has 21,000 employees compared to Airbnb’s 6,100. This, however, leads to a net income for an employer that is substantially lower than Airbnb’s ($24,761.90 vs $ 130,689.01). The company will clearly benefit from the huge travel demand we will see this year, but we may expect it to grow at a slower pace from 2023 on, which, in any case, should be at least around 5%, the expected growth rate for the travel industry from 2022 to 2027.

One thing to consider is that Booking has the advantage of being a less volatile stock than Airbnb. This year, for example, while Airbnb is down 27%, Booking only lost 5.5%. It is also more diversified, which will expose it to all the growing travel trends we are seeing in place. Booking is thus the right stock for investors who want to be exposed to the travel industry, but want low volatility and mature companies with a strong track record in their favor.

Airbnb, on the other side, has quite higher multiples than Booking and is thus more expensive. Even after being almost cut in half from its ATH, the stock trades at a P/E of 44, twice as much as Booking’s. Its price to sales is 11.38 versus Booking’s 7.43. The forward EB/EBITDA is 28.78 compared to Booking’s 16.71. Not by chance, Seeking Alpha’s quant rating has an F for the stock’s valuation. However, things change a bit if we consider Airbnb to be a growth stock. The company is growing faster than Booking and we see this by the fact that it already recovered from the pandemic, while Booking is needing more time. Airbnb’s EPS is expected to be almost 2x today’s by 2023. With doubling earnings per share, the fwd P/E is quite lower than 44, nearing Booking’s current valuation. However, I actually expect Airbnb to beat earnings expectations for the next quarters and it would not be surprising at all if by the end of this year Airbnb’s EPS will already have doubled, given also the benefit of cost management that the company has undertaken. In this case, Airbnb becomes a very alluring buy that may reward investors who can withstand greater volatility.

Conclusion

I started by pointing out that if even retailers are telling us about a 50% increase in luggage spending we are going to see in the next two quarters a massive surge in travel and leisure. Because some parts of this industry are strongly linked to fuel costs and inflationary raw material pressure, I would prefer to invest in platforms that don’t have to deal as much with these problems.

Both Booking and Airbnb are set to great performances for the rest of this year, starting from Q2. Both of them are buys right now, but I would suggest to buy Booking to those who want to take advantage of this surging travel tide, but need to have safer criteria for their portfolio. To investors who have more time on their side and can withstand higher volatility, Airbnb may offer great rewards over the next few years.